Evolution of Addiction

Addictions are bad, but have stood the test of time and, in turn, have led to large companies emerging over time in each century that have massively gained from them.

What is addiction?

Merriam-Webster defines addiction in the following way:

Addictions are a part and parcel of life.

For most of recorded history, addiction has been common to human beings. It seems human beings are addicted to having addictions, or in other words, habituated to a state of being addicted.

While earlier addictions like chewing/smoking tobacco, opium, and alcohol were more substance-oriented, the modern-day addictions are more behaviour-oriented and activities, like social media addiction, gaming addiction, and even for a few individuals, exercise addiction.

The form of addiction has changed over time and is continuously evolving, but the fact remains that it is a profitable business.

Addictions, in simple terms, are bad habits that you are not able to stop repeating ( which, as books like Power of Habit demonstrate, habits once set are difficult to change ).

Why do addictions lead to good business economics?

When we think from a business lens through the commonly used LTV/CAC (Lifetime value from the customer/ Customer Acquisition cost) terminology in VC.

Addictive products have one of the best LTV/CAC metrics you would see

The customer acquisition cost (CAC) for addictions is spent mostly on the early teenage years. The earlier you smoke your first cigarette, the greater the chances are for you to develop a smoking habit in the future. Similarly, a Harvard Medical study on Social media usage of American kids in 2024, based on 2022 study data, suggested that social media campaigns made a total of $11 Bn revenue from just the kids segment (Link)

The playbook for addiction-oriented business seems to be clear:

Get customers hooked from an early age, many of them will turn into regular customers (or addicts) by the time they turn into adults, and may continue to use it over a lifetime. I am not saying this is a good thing per se from the consumer lens, but this is how businesses have worked. If someone has access to the product below 18 years of age, then they may try it out initially, thinking it is not harmful, but eventually may keep on doing it because of habit formation in the early days.

This leads to a very high lifetime value as the customer is already in the habit of consuming the product (smoking, alcohol) or doing the behaviour (checking their Instagram) from an early age, and it does not require any re-targeting to purchase further.

CAC is also lower than most businesses because of the high degree of accessibility and awareness

CAC is also lower than Instagram, Facebook, or YouTube, many times come pre-installed on devices. For tobacco companies, it is illegal to advertise their cigarettes; thus, they cannot have large marketing budgets anyway, but are accessible across countries at short distances or on online QC platforms. Similarly, alcohol is globally available in most districts and supermarkets in most developed countries.

This gives easy access to the customer, which reduces the cost of customer acquisition, as most customers are already aware of the products.

The strong business economics are the reason that Altria (Parent company of Phillip Morris, makers of Marlboro) has been the best-performing stock over the last 100 years across the US stock universe, showing strong business economics.

The company has had a CAGR return of 16.29% over the last 100 years, compared to 10.46% per year.

This is what a $100 investment in Altria would look like versus the S&P 500 over the last 100 years. That’s a 171x difference showing superior economics than most top-performing businesses over time.

Thus, from a business perspective, it is important to study how addiction is evolving, as good or bad, unless there is strong self-regulation by the companies themselves or the government, it is unlikely to stop in the future.

The first section was an overview of what piqued my interest in the topics and why I believe they should be studied in depth. In this section, I deep dive into how addiction has evolved over the centuries before we look at what could be the possible forms of modern addiction.

Addiction in the Period before the 1900s

Before the 1900s, there were 3 main sources of substance addictions - tobacco consumption, opium and alcohol consumption.

The major growth in the consumption started with the rise in colonialisation. Before colonialisation, the consumption of these substances was prevalent; however, it was restricted to local communities and was not pursued solely for maximising revenues or profits from these.

With colonialisation, these substances became integrated into daily life. Alcohol facilitated social gatherings and religious ceremonies, while opium was used medicinally and recreationally, particularly in Asia. Tobacco became a status symbol in Europe, with smoking rooms emerging in affluent homes.

Source - Link

With the rise of colonial empires. Opium and Tobacco were the main substances that showed high growth in this period.

Britain and the Dutch scaled opium production in their colonies, powering increased exports and revenues from the opium trade before the 1900s

The British East India Company was a major player, controlling opium production in India (Majorly in Bihar and Uttar Pradesh where large scale industrial scale cultivation was happening to cater to the increased exports and was majorly unprofitable for the farmers themselves) and its export to China, generating immense profits during the 18th–19th centuries. At peak in the 1880s (after China lost the opium wars in the mid 1800s), 100k chests were being exported by the British East India Co. from India to China.

Similarly, the Royal Dutch Trading Company’s opium monopoly in the Dutch East Indies – modern day Indonesia – returned astronomical profits that financed a range of national enterprises (Link)

The Americans profited from the subordination of 19th-century China. A small group of traders from established East Coast families, and a few well-connected interlopers, made fortunes from the opium trade, which helped in funding railroads (Link).

North and South America led the rise in tobacco production in the 1900s

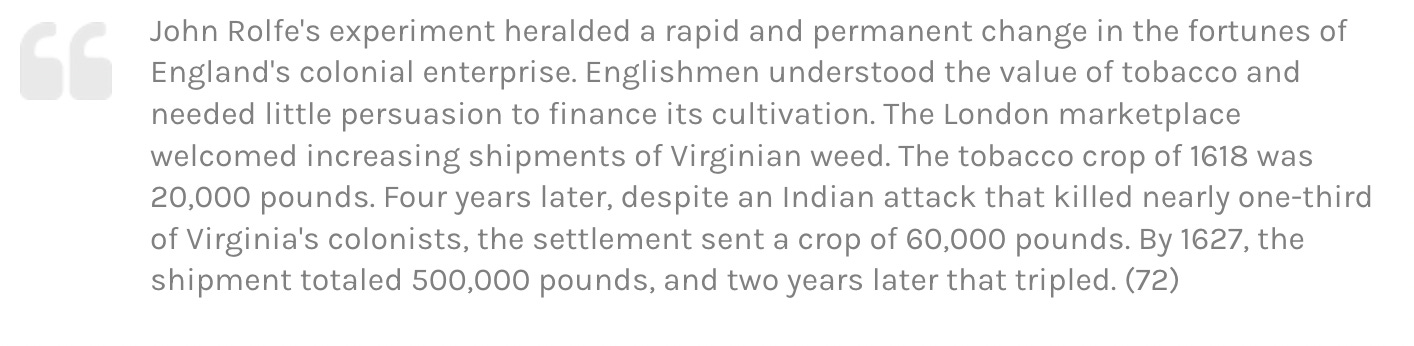

Tobacco originated in the Americas, where it was used traditionally for thousands of years. When the Europeans arrived in the Americas, they started exporting it back to European countries, where it saw strong demand for the product. Slowly, Europeans started producing tobacco at scale in the Americas and then in North America, leading to a rise in tobacco plantations. To get an idea of the scale, from 1618 when shipments started at 20,000 pounds, it increased to 1,500,000 pounds by 1629. 75x growth in production in 11 years, showing how well the product was accepted in European markets at that time.

In the case of tobacco, Colonial enterprises, such as the Virginia Company in the Americas, and early European tobacco traders like the Dutch and British merchants, capitalised on tobacco’s popularity. No single modern corporation dominated, as production was decentralised.

Addictions from 1900-2000s

In this period, I would like to cover two major industries that were formed during this period and have achieved massive scale since then - Cigarette and another is alcohol.

What led to the rise of smoking cigarettes?

Before the 1900s, cigarette smoking was not as prevalent, and people mostly used to chew or smoke tobacco. However, post-1900s, cigarette smoking became much more prevalent, bolstered by three reasons.

First, the invention of the first commercially viable cigarette rolling machine in 1880 by James Bonsack led to the rise in the industry. Before Bonsack's invention, cigarettes were exclusively hand-rolled, a process that severely constrained production capacity. Even the most skilled workers could roll 4-5 cigarettes per minute, which made it a luxury. The Bonsack machine produces 210 cigarettes per minute, leading to a significant expansion in the efficiency of cigarette production.

Secondly, companies like Phillip Morris and Lucky Strike, through their creative ad campaigns, led to the mass popularisation of the industry with their marketing campaigns. If you have seen Mad Men, you would recall the It’s toasted campaign suggested by Don Draper to the Lucky Strike management.

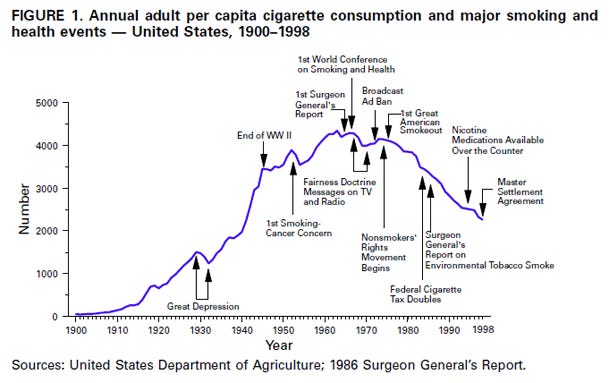

This led to a major rise in the per capita cigarette consumption, especially in the US, where an adult was averaging ~ 4000 cigarettes per year (or roughly 10 cigarettes per day)

The third reason was the popularisation of masculinity and cigarettes during wartime, which increased their consumption. The soldiers were also rationed cigarettes along with the food, which would suggest habit formation taking place during this time.

However, as the fight against big tobacco started as people started to realise the health hazards of smoking over long periods, the consumption started to decline and has been trending downwards, with people in the 21st century looking to transition into other forms of nicotine consumption and away from smoking.

In most developed countries, a similar journey has followed, where countries have made rules to curb smoking, leading to lower prevalence in most countries. Most countries, except for a few, are represented in blue, showing that over the 30 years from 1990 to 2019, there has been a decrease in the prevalence of smoking. This means that the % of people out of the people who smoke is continuously decreasing.

However, the absolute number of smokers has increased, especially in the developing countries in the Middle East, Africa and the Indian Subcontinent.

Big companies that have benefited from the cigarette addiction over time

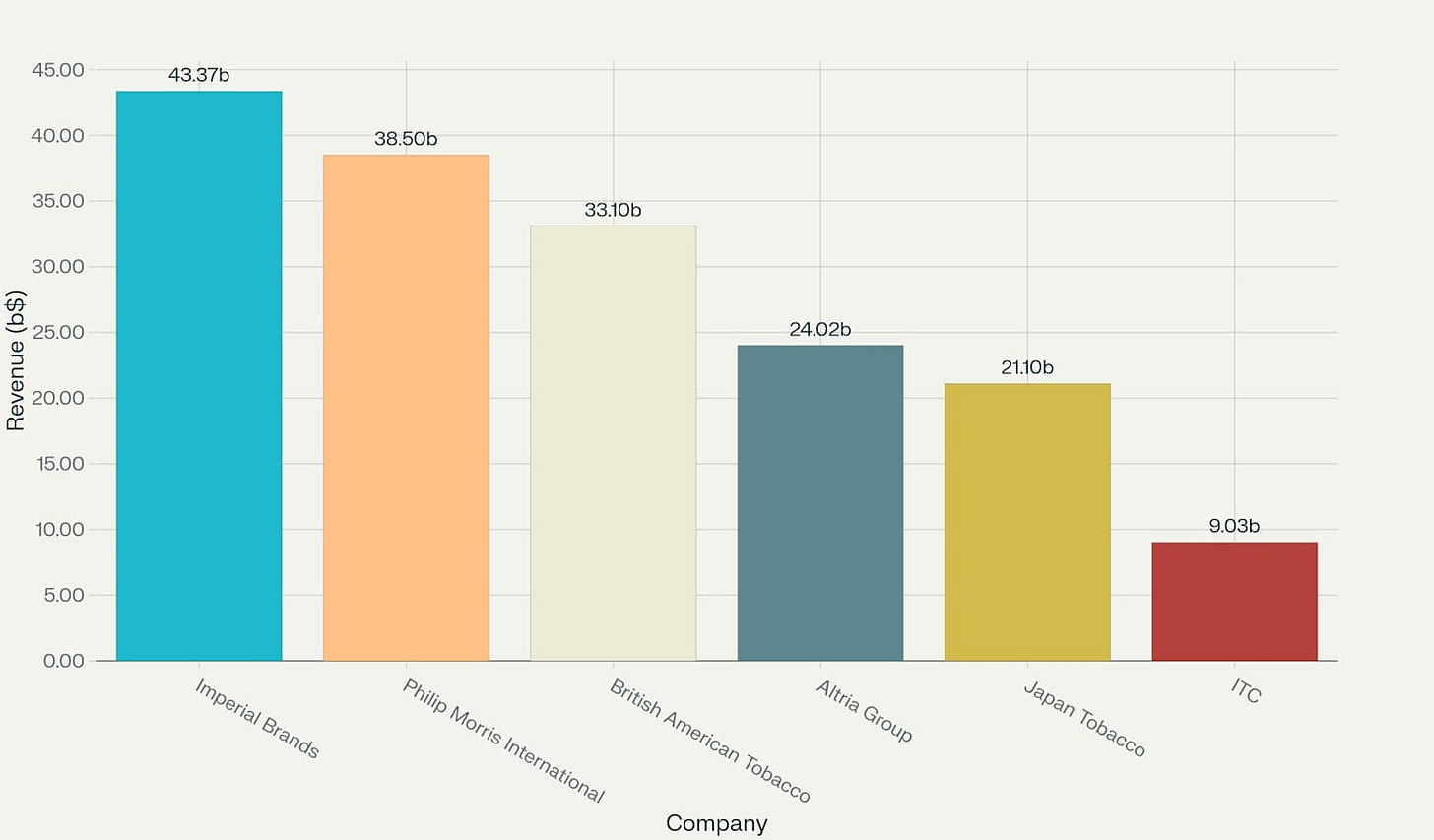

Even though with increased awareness about health risks, no marketing allowed, price increase, and active discouragement towards smoking through regulations in public places, the cigarette industry continues to make healthy profits and has substantial revenues in both India and abroad

Alcohol Consumption has continued to stay relevant even though the newer generation thinks it’s bad for health.

Alcohol is the most available, widely consumed recreational drug globally. Beer alone ranks as the world's most widely consumed alcoholic beverage and the third-most popular drink overall after water and tea.

Alcohol production and consumption developed independently across many cultures.

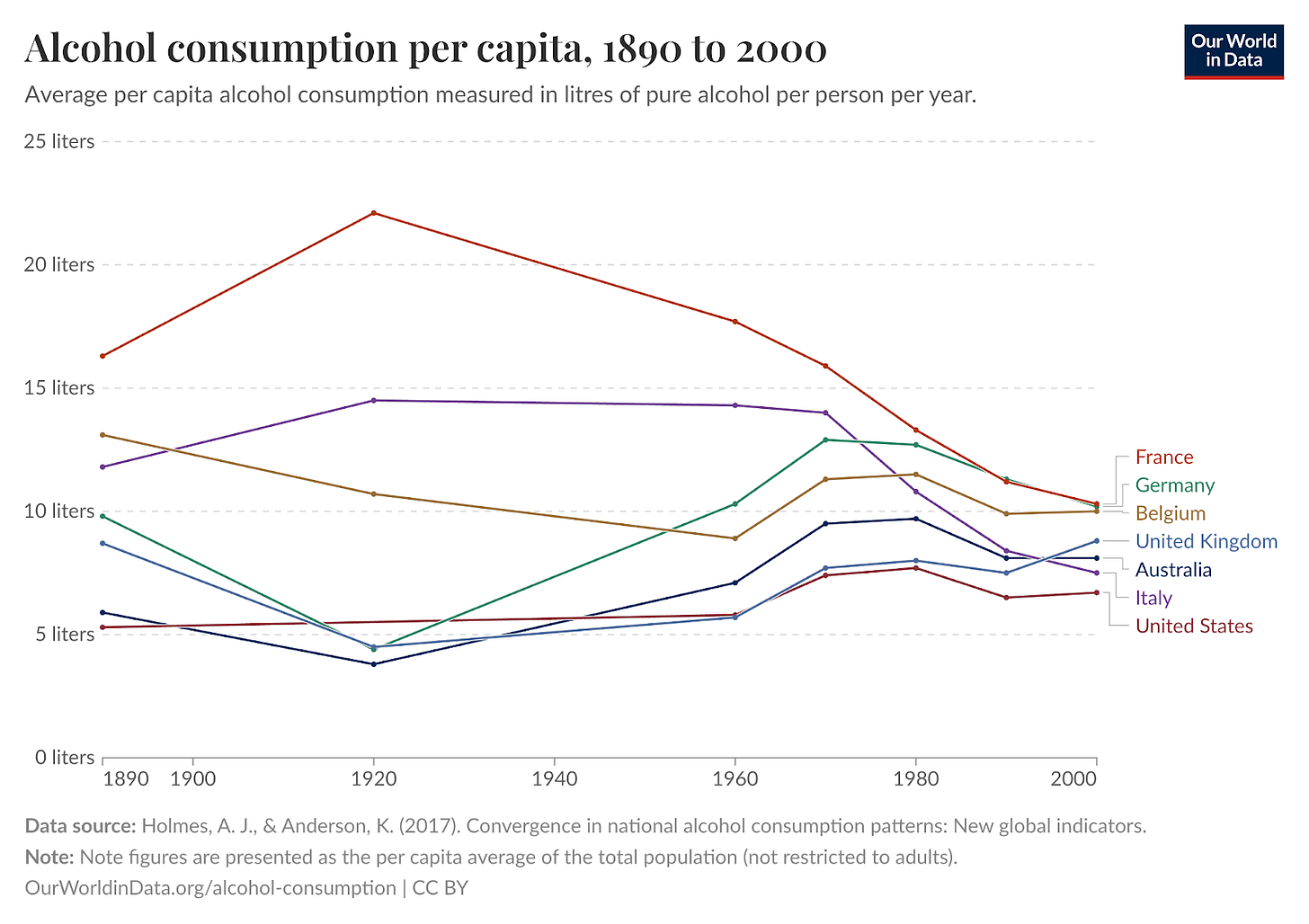

Historical consumption levels were sometimes dramatically higher than today. In countries such as France during the 1920s, the average consumption was 22.1 litres of pure alcohol per person per year, equivalent to 184 one-litre wine bottles annually.

Big Players in the Alcohol Industry

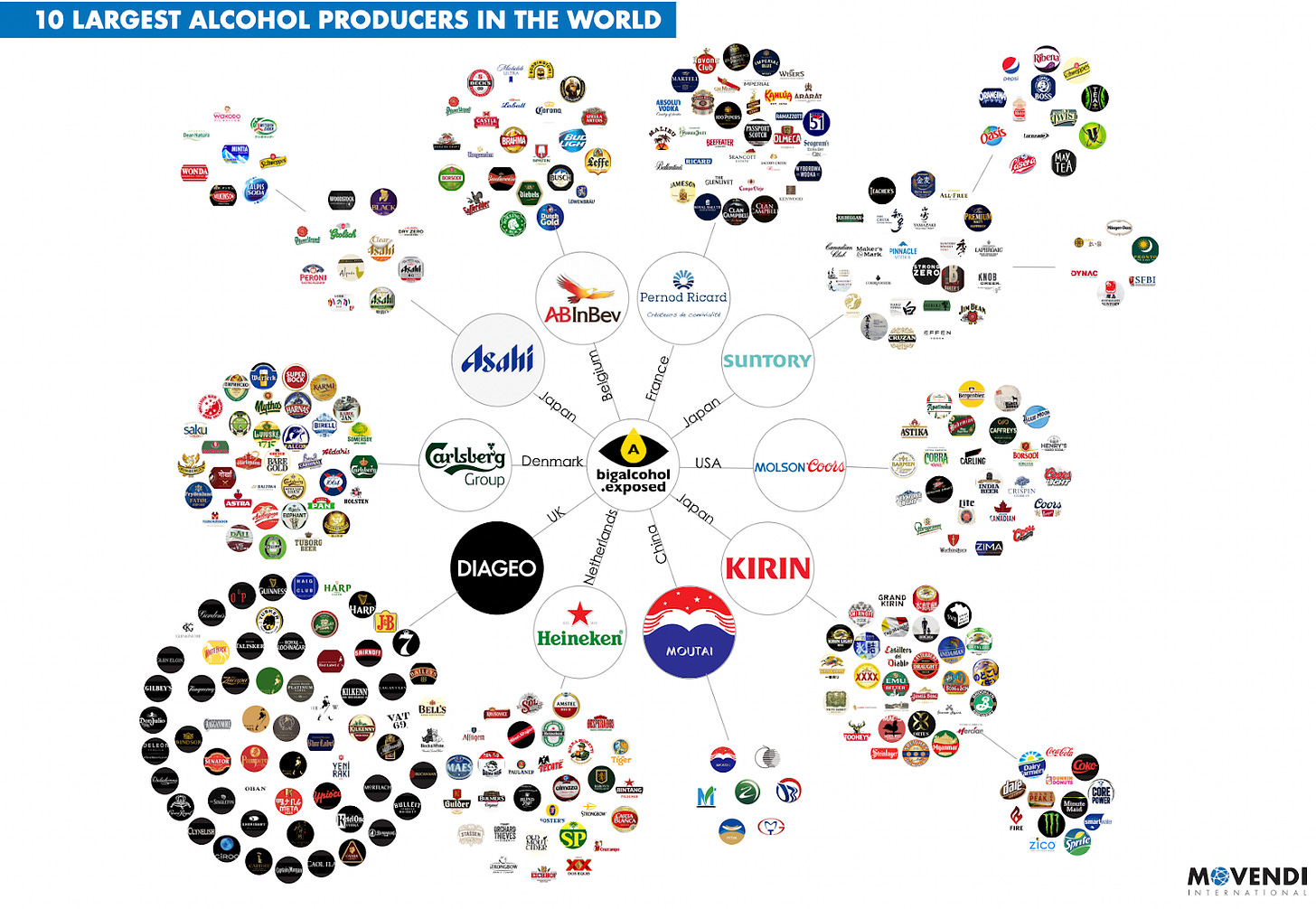

The alcohol industry has seen major mergers and acquisitions happen over time. This has led to multiple brands being under the same holding company. If you zoom into the chart below, you will see that most of the brands of the alcohol industry have been consolidated into these 10 bigger brands.

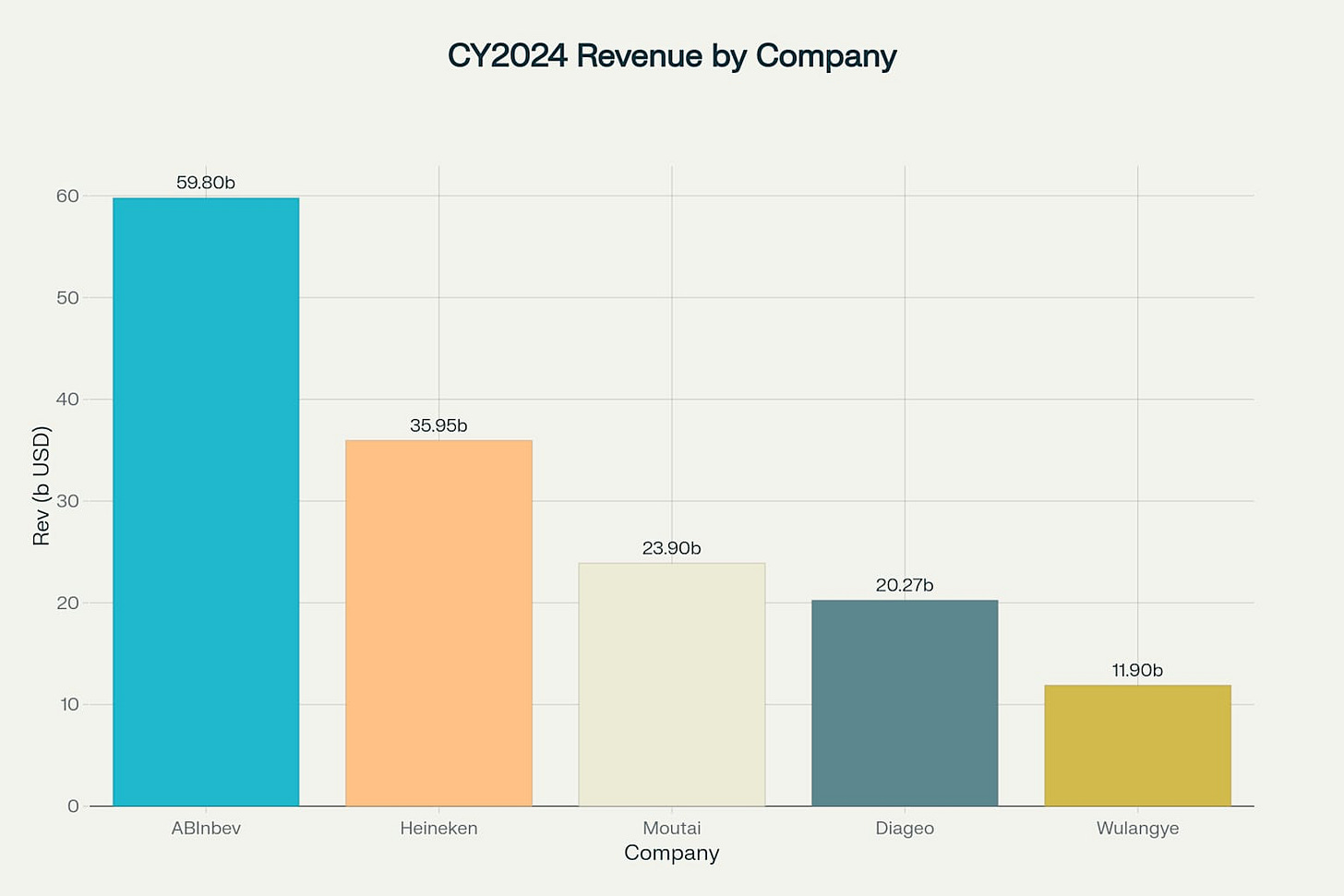

The leader in the alcohol industry globally in terms of revenue is AB Inbev. Followed by Heinken and the Chinese firm Kweichow Moutai.

Younger adults are considering moving away from alcohol

However, according to a recent Gallup poll, Young adults in the US are increasingly considering moving away from alcohol.

Addictions in the 2000s and beyond:

People are switching from cigarettes and alcohol to more recreational drugs and nicotine replacement products

As people move away from increased cigarette and alcohol consumption in developed countries and more slowly in developing countries, there has been a rise in cannabis consumption and nicotine replacement therapies.

Increased Cannabis Consumption due to increased legalisation across the globe

The cannabis market has grown significantly over the years, with many countries legalising Cannabis, such as the US (26 States), Canada and some countries in Europe. Further, legalisation is accepted in countries like Germany, South Africa and Colombia shortly.

According to Statista, revenue in the Cannabis market worldwide is forecasted to reach US$68.47bn in 2025 (Link). The United States is the largest contributor, expected to generate US$45.35 billion in 2025, underscoring its significant influence in the global landscape.

Consumption habits and products are diversifying.

Traditional flower remains dominant, but edibles, vapes, beverages and concentrates have surged. For example, U.S. pre-rolled joints became the fastest-growing category, reaching $4.1 billion in sales in 2024. New forms (THC-infused drinks, pre-filled vaporisers) are attracting users who prefer alternatives to smoking. Moreover, a sizable share of new consumers view cannabis as an alternative to alcohol (surveys show ~21% of “Dry January” participants use cannabis/CBD instead of alcohol.

Multiple Big players have become established in both the US and Canada

Major players like Curaleaf ($1.34 Bn), Tru Lieve and Green Thumb each surpassed $ 1 billion in revenue for 2024 (Link), reflecting their scale as leading multi-state operators.

Tilray (resulting from the Tilray–Aphria merger) and Canopy Growth are the largest Canadian players, with diversified businesses including beverages and medical cannabis.

Curaleaf - Establishing itself as an integrated player from the farm cultivation to retail distribution, scaling to $1 Bn in revenues

Curaleaf operates as a vertically integrated cannabis operator, controlling the entire supply chain from cultivation and processing to retail distribution. It has branded products across flowers, edibles, pre-rolls, lozenges, etc.

Tobacco/Cigarette smoking alternatives like Vapes, Nicotine Pouches, and Patches are gaining more acceptance across the globe, with a good runway to grow further

Vape is the clear winner in terms of tobacco alternatives, with nicotine pouches like Zyn seeing increased traction among Gen Z.

The global e-cigarette and vape market has experienced explosive growth, expanding from approximately $2.5 million in 2016 to an estimated $30-40 billion in 2024. This is expected to grow to a trillion-dollar industry over the next two decades.

Nicotine patches were originally tried but have not had as much success, while Nicotine pouches and lozenges are showing a really good pickup in sales, with brands like Zyn (a Phillip Morris International-owned brand) doing well.

Even in close homes in India, Zyn (Not available in India, out of stock on Amazon) has growing Google search trends than Nicotex (Famous for their Nicotine replacement products), which is on a decline.

Who are the major players in this industry?

Juul Labs - The Initial Poster Child of the E-cigarette industry

JUUL Labs emerged as the dominant force in the e-cigarette market, demonstrating unprecedented growth that transformed the industry, reaching close to $1 Bn in sales in 2018 after being founded in 2015 as a spin-off from Pax Labs

The company's market share surged from 27% in September 2017 to 68% by mid-2018. By late 2018, JUUL was valued at approximately $38 billion after tobacco giant Altria purchased a 35% stake for nearly $13 billion.

However, the concerns of teenage vaping and regulatory actions led to it collapsing, as shown in the Netflix documentary Big Vape that came out in 2023. By 2022, Altria had devalued its investment to just $250 million, and in March 2023, exchanged its ownership stake for licensing rights to JUUL's intellectual property.

IMiracle - The majority of the sales in the current market post-Juul have been led by a Chinese company called I-Miracle (Founded 2007 under the parent company Heaven Gifts, by Zhang Shengwei, a 50-year-old entrepreneur who has become known as the "godfather" of the vaping industry in Shenzhen). According to a 2023 Fortune article (Link), 90% of the world’s cigarettes are produced in Shenzhen. iMiracle is most notably recognised as the manufacturer behind Elf Bar, the world's most popular disposable e-cigarette brand as of 2023. The company also produces other major vaping brands, including Lost Mary and EBDesign. The company is mainly focused on exports, as there is a domestic ban by the government on flavoured vapes.

(Source - BBC)

IQOS - IQOS falls under the heat-not-burn (HnB) category, where it holds 77% global market share. IQOS, developed by Philip Morris International, is the most prominent HnB product globally. The device heats tobacco to approximately 350°C for about 6 minutes or 12-14 puffs, allowing users to experience tobacco flavour without many of the harmful byproducts of combustion. The market is highly concentrated, with major players including Philip Morris International's IQOS, British American Tobacco's glo, and glo iFuse.

Zyn - ZYN (Founded 2014), a Swedish brand of nicotine pouches created by Swedish Match (Acquired by Philip Morris International for $16 Bn), has achieved extraordinary market dominance of ~70%, particularly in the United States. The pouches are designed to offer a smokeless nicotine experience by being placed under the upper lip, and they come in a variety of flavours and nicotine strengths. Zyn shipments in the U.S. have quadrupled since the first quarter of 2022, and reached 202 million cans shipped in Q1 2025, showing the popularity of the white pouches, especially among Gen-Z working professionals.

Behavioural Addictions are likely to become the dominant cause of addictions in the next century.

Social Media, Streaming and Gaming are optimised to get us hooked

A study by Statista on the distribution of the time spent using mobile apps worldwide in 2024, by category, showed 3 categories (Social media, Entertainment and Gaming) that topped usage metrics, apart from utility and productivity apps. This is where the major behavioural addictions are likely to develop.

The daily time spent on social networking by internet users worldwide from 2012 to 2025 (in minutes) has increased from 90 minutes in 2012 to 141 minutes in 2025. This is a significant number, even if it is declining a bit, as it represents about 2 hours and 20 minutes being spent on social media. Assuming 7 hours of sleep daily, out of the 17 waking hours, this represents ~14% of awake time being spent on social media.

Food-related addictions due to ultra-processed foods and sugary products are likely to go up, with more people developing habits of fast food early in their lives as compared to limited exposure for earlier generations especially in developing countries.

Both processed foods and sugar activate the brain's reward system, especially pathways involving dopamine, like addictive drugs like nicotine or alcohol. This activation leads to pleasure, reinforcing repeated consumption and making it difficult to cut back. This is likely to go up in the future

What would the future addictions look like?

Metaverse - If Mark Zuckerberg's experiment with Meta goes through in the next decade, enabled by AI and better hardware, a Ready Player One-like world to live in where people connect digitally more than physically might start becoming a possibility

AI companions or non-playing characters - Some of today’s most popular companions include Snapchat’s My AI, with over 150 million users, Replika, with an estimated 25 million users, and Xiaoice, with 660 million. And we can expect these numbers to rise. (Link)Thus, AI companions are already reaching scale. And we have already started seeing stories of how children are being affected by the relationships developed with AI companions.

While initially AI companions can be seen as an escape from loneliness or someone who has your back, the long-term implications of how they affect people, especially children and younger adults, in relationships and self-development.

Conclusion

To conclude, companies will continue to focus on getting you hooked or addicted to both good and bad things. This is how they maximise their lifetime revenue from the customer, either resulting in you buying more vapes from them or giving more of your awake time to you. Thus, it is important for us as -

→ As consumers, to first need to realise how these loops work and whether we are getting addicted to them. For example, tracking your screen time usage might be a good way to become cognizant of how much time you spend on different apps.

→ Letting go of behaviours that seem like routine, like smoking, drinking, or social media, for short periods might help you realise if you are addicted or not

→ As investors, it is important to realise how these companies' habit loop formation takes place, if it is sustainable and be cognisant of the regulatory concerns raised against most addictive companies (For example, the fight against big tobacco post 1950s and states in India becoming dry states).

My goal from this article in no way is to promote addictions, but to provide a more realistic picture of the industry, as we admit or not, are directly or indirectly impacted by companies who want us to get hooked on their products. Thus, instead of ignoring or not writing about the industry, we should take a more realistic view and become cognisant of where it is trending.

Let me know in the comments what you're addicted to recently?