Can PhonePe become the next Bajaj Finance in cross-selling?

Once in a while, most of us would have a Bajaj Finance Customer Care call selling us a pre-approved personal loan or some other product that we don't want or need

In my experience, this makes me highly irritated at times, especially the persistence with which they keep on calling

But this persistence, which might be irritating on an individual level makes them the financial behemoth they are today

Bajaj Finance has a massive customer base to cross-sell

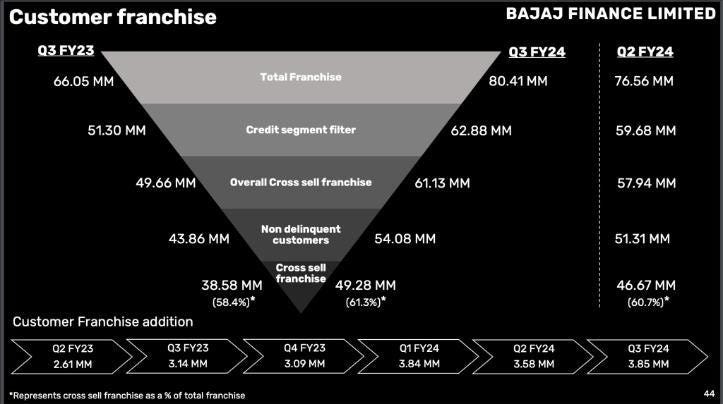

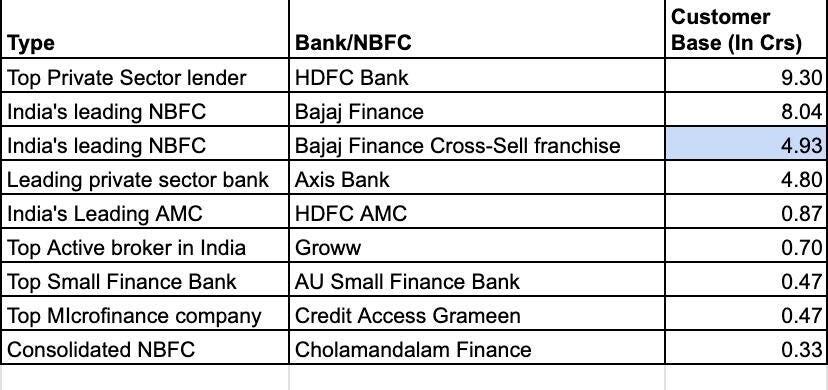

Bajaj Finance's cross-selling franchise is one of the strongest even compared to large private sector banks like HDFC and ICICI. They already have 8 crs customers, thus giving them a strong top of the funnel for starting their cross-sell franchise. Out of this, they filter the customer with good credit scores who have not defaulted on their loan payments. This helps them arrive with good quality customers to which they can cross-sell their loan products

As of Dec 2023 results, they have a cross-sell franchise of 4.93 crs, this is 61% of their total customer base of 8.04 cr.

How big is this number?

Their cross-sell franchise is bigger than the customer base of Axis Bank, the leading private AMC (HDFC AMC) and the leading broker (Groww) of the country. This shows the power of Bajaj Finance cross-selling franchise

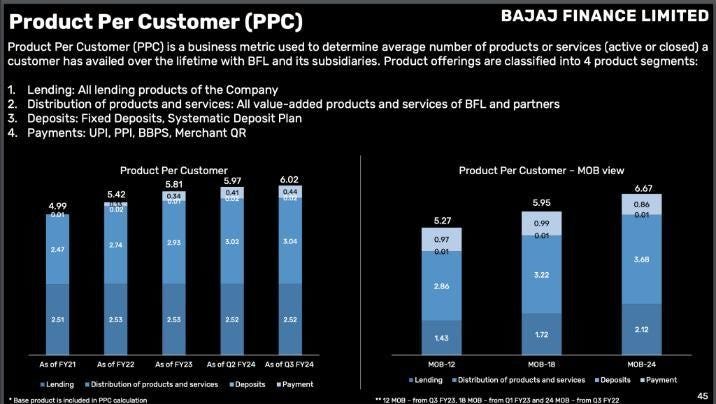

Products per customer - A metric showing the prowess of cross-selling

Their product per customer is currently at 6.02, with a customer having 2.52 lending products on average from Bajaj Finance. This is likely to grow as their Bajaj Super App is also growing reaching 5 crs downloads, thus providing an omnichannel approach to lending

Bajaj Finance acts as a useful case study for a new-age fintech building their cross-sell franchise

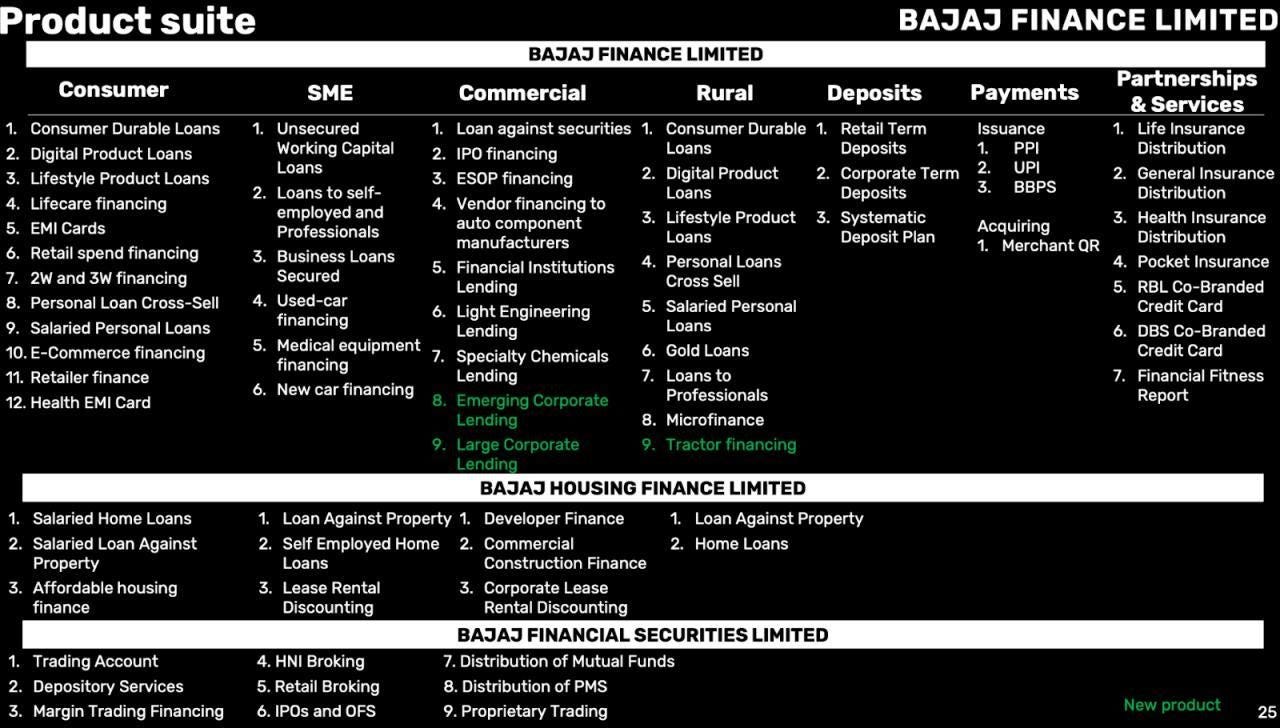

Bajaj Finance is an ongoing case study of how to build a diversified lending book. As most fintech, are now diversifying into lending and trying to cross-sell loan products to the customer, Bajaj Finance's development from being an auto lender to becoming a diversified lender can be studied to see how new lending verticals can be entered and scaled

The company is not stopping and is moving into corporate lending and tractor financing, Q3FY24 onwards. This comes after it announced its foray into microfinance in Q2FY24

Startups building in the fintech space, especially the ones now entering into lending can learn a lot from Bajaj Finance on how to build a strong cross-sell franchise and monetise it effectively

Can PhonePe do a Bajaj Finance ?

PhonePe is one of the Indian startups to look at as they are entering the lending space. PhonePe has a registered user base of 51 crore customers and 3.8 crore merchants. This user base is even more massive than HDFC Bank’s 9.3 crs customer base as Dec 2023. Even the merchant side on its own, has a substantial customer base to cross-sell

In 2023, PhonePe was a clear market leader in the UPI Space with 47.2% of all transactions being processed by PhonePe

The number of UPI transactions and consumer data that PhonePe is huge. PhonePe processed 4,990 Cr UPI transactions worth INR 81.96 Lakh Cr in 2023 (Till November 2023)

PhonePe if it can cross-sell its lending products effectively to the consumers has the opportunity to become one of India’s biggest lenders given it has one of the largest customer bases available to any fintech app/traditional lender

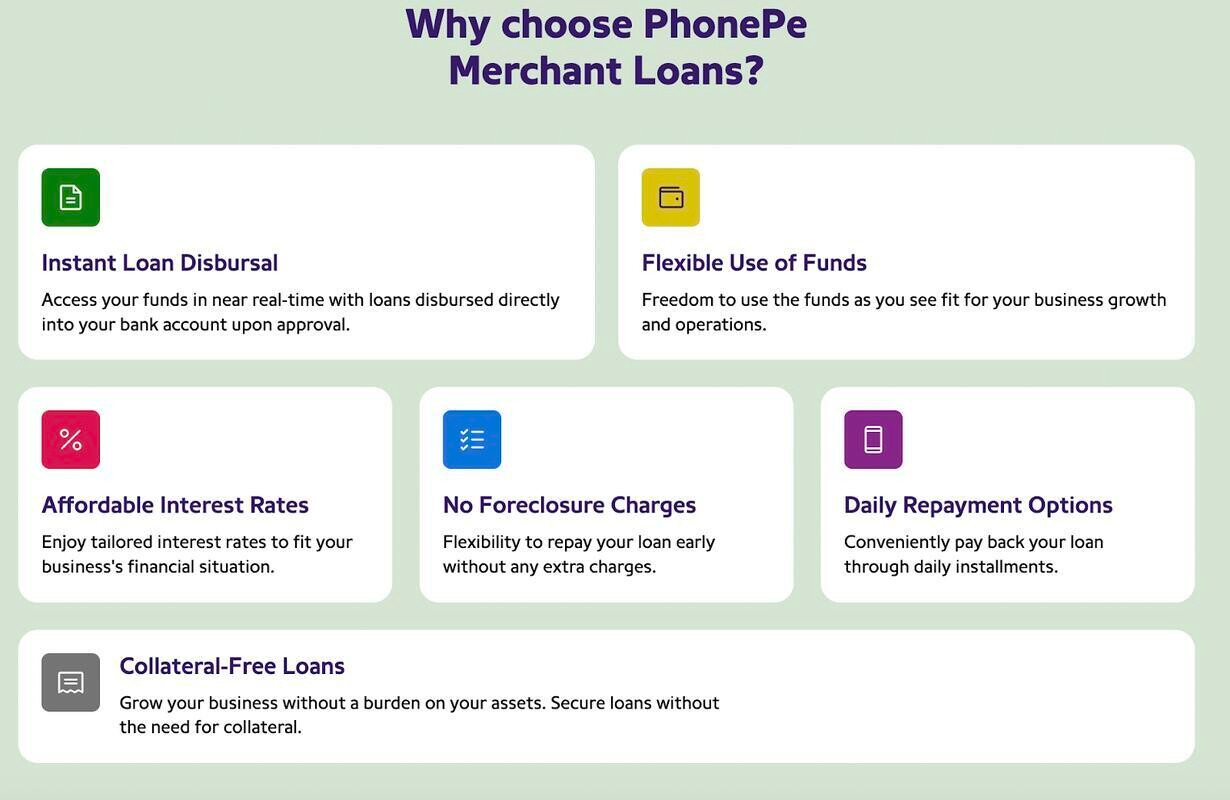

PhonePe already cross-sells its insurance policies, provides investment products and provides merchant loans to its business partners. It’s currently in the phase of launching its consumer lending business with 5-6 lenders on a distribution model as it builds its proprietary credit underwriting models.

I believe with the largest customer base (51 crs customers, 3.8 crs merchants), among the fintech it has one of the best chances to replicate a Bajaj finance-like model where it can offer different financial products to the same customer and can have more than 3 or 4 products per customer.

Customers already using UPI can provide them with credit on UPI/lending products. cross-sell insurance and help them invest in MFs/Direct stocks through their app.

PhonePe recent re-organisation that creates separate chiefs for the lending, insurance, share market and Pincode, will further help them to segment the customers based on their financial needs, thus helping in having more targeted products per customer

Thus, given the current scenario, PhonePe can learn a lot from Bajaj Finance on how to cross-sell to its customers and if it can do it effectively, it might just become bigger than Bajaj Finance in terms of cross-sell franchises.

Phone with 50 crs customers, if it can cross-sell even 1 product on 50% of its customers, it will have a cross-sell franchise of 25 crore, which is 5x of what Bajaj has currently and 2.5x of HDFC’s total customer base. The opportunity for PhonePe to exploit currently is massive and now is a good time to start, given PayTM’s uncertain future

Note: As I only wanted to focus on the fintech vertical, I have not included Pincode (PhonePe’s ONDC app) in this article, which can be a further additional product to cross-sell to consumers

Disclosure: This article is for education purposes only. Not a buy/sell recommendation.