Building Wealth Management Solutions for Mass Affluent Indians

As the number of affluent Indians rise accompanied by the rise of digital public infrastructure and Account Aggregator, it opens up an opportunity to manage wealth at scale

Post-Covid, the sharp rally in equity markets that lasted till Sept of last year had led to an increased interest in the markets.

The rise of fintech influencers, along with the high demand to learn about the equity markets, has led to a lot of education among the consumers as well as multiple fintech apps to cater to the consumer needs for diverse assets.

The rise of apps like Ind-Money and Vested allowed access to global equities for the Indian consumer with the ease of a button, while companies like Grip Invest and Wint Wealth opened up a whole new class of assets. Groww, hyper-scaled to becoming the largest broking platform with more than 13 mn users, and Stable Money helped open up high-interest FDs to more than 1.5 mn consumers. This has led to more fintech companies creating diverse products catering to the same user who is currently learning about these products.

In India, the number of mass affluent households is expected to rise from 14 mn (FY 2023) → 21 mn (FY 2027). This is the right time to help these young working professionals or business owners as their numbers increase to manage their finances and build their wealth in a digitised manner as the complexity of managing their finances increases multifold.

What is the mass affluent segment?

A Praxis Global Alliance study defines mass affluent by net worth between ₹40 lakh and ₹4 crore (~$50k–$480k). They estimated 14 million mass affluent households in FY2023, rising to 21 million by FY2027, this is a 50% increase in the number of households that we are likely to witness. (Link)

In other words, ~5% of Indian households hold investable wealth in this “mass affluent” band.

According to other estimates Goldman Sachs defines “Affluent India” as individuals with per capita income above $10,000 annually (approximately ₹8 lakh/year) – roughly the top 4% of working-age Indians. This equated to about 60 million individuals (12–14 million households) in 2023. Roughly arriving at the same ~14 mn households

Combining these definitions, we can infer the mass affluent segment in India comprises on the order of 12–14 million households (About 60 million individuals) as of the mid-2020s. This segment sits between the very small truly rich elite and the hundreds of millions of “mass” households.

Why wealth management for the mass affluent segment for ?

The Incumbents

The wealth management sector in India has seen significant growth in the last few years post-Covid. Traditionally, the wealth management sector especially banks and boutique firms served people with net-worth of more than 30 crs+ and investable amounts of 5-10 crs at minimum. These were just largely catering to the top few thousand families

Source : Investor presentations

The Challengers but for the HNIs

The second wave of wealth management has been the rise of startups like Dezerv, Centricity, Neo Asset management trying to create a wealth management services for people who have atleast Rs. 50 lacs of investable capital. or SaaS solutions for MF distributors serving these clients

No big company yet.. catering to the mass affluent segment yet

This leaves a whitespace, where there is still no one large fintech trying to catering to the segment of mass affluent households and working professionals who may not able to put a large part of their net-worth with Dezerv but instead require help either through a DIY solution or a human-advisor assisted solution that eases the burden of man their wealth.

What has happened globally that has not taken off yet ?

India did Robo-Advisors but not very successfully:

In the US, robo-advisors like Betterment and Wealthfront launched ~2008–2010 and accumulated billions in AUM by offering algorithm-driven portfolios (typically low-cost ETFs) for a modest fee. They targeted young professionals who wanted a set-and-forget investment approach. In India, pure robo-advisory didn’t take off initially – early efforts by 5nance, Arthayantra or Scripbox around 2015 struggled. Robo-Advisory has only taken off in the recent years (Will discuss the Scripbox example below)

One reason is that Indian investors often prefer some human reassurance or to actively pick funds/stocks. Culturally, trusting an algorithm was a leap. Instead, Indian wealthtechs blended robo principles with human curation (e.g., Scripbox had algorithms to pick top funds but explained in human terms).

A true low-cost robo-advisor at massive scale hasn’t happened yet – however, given rising numbers of DIY investors, this could still play out with better technology and after the current crop of users gains more trust in automation.

Hybrid Advisory (Personal Capital model): Personal Capital in the US (now Empower) offered free financial tracking software to attract users, then upsold a paid human advisory service for those with >$100k. This mass affluent hybrid model worked well – Personal Capital managed ~$12 billion before acquisition. In India, INDmoney is somewhat akin – free net worth tracking, and it is a registered investment advisor. Companies like Fold Money are also trying to target the same space (Discussed below).

Why the time is ripe now?

A convergence of factors makes a mass affluent wealth app the opportunity to grab:

Explosion of affluence: As detailed, millions are crossing into the investable surplus range. The number of households in the mass affluent segment is going to increase by 50% leading to 7 mn more households being added. While the existing households wealth will also keep on increasing over the year, expanding their total net worth. This increased net-worth is increasingly going to MF (4%, FY14 → 9%, FY27) and Provident/Retirement funds (8%, FY14 → 20%, FY27) with Indian households reducing money held in cash, savings deposits and term deposits

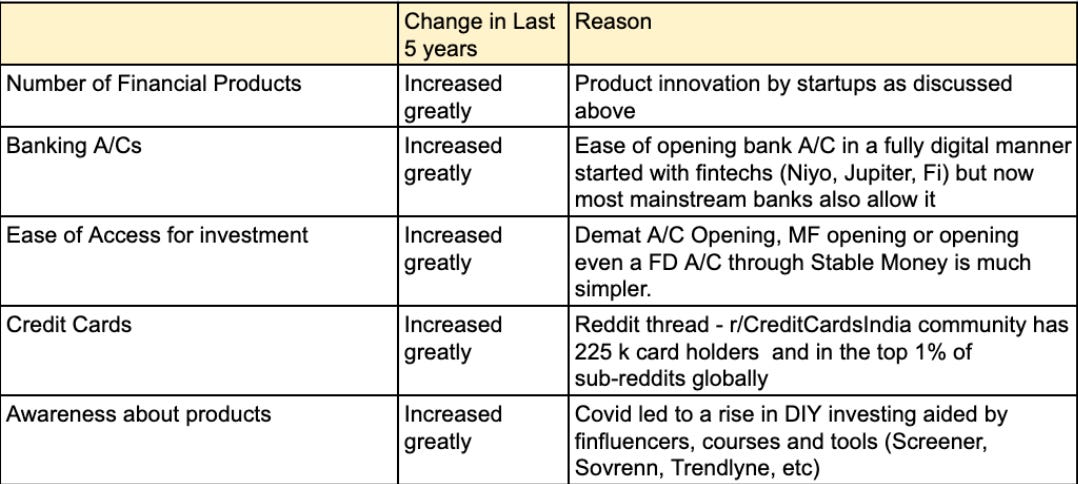

Complexity has increased greatly - Their needs are more complex than what robo-advisors of the 2010s handled. The initial set of robo-advisors were companies like Scrip Box (Founded - 2012, FY24 revenues of Rs.90 crs and total funding raised of $80 mn). These companies allowed you to do goal based financial savings based on simple SIPs. However, this proposition took off only recently, with only the last 3 years seeing some meaningful growth and ScripBox has now reached an AUM of 18000+ crs.

However, the world is not so simple as it was back when, now you have the option as a retail investor to invest -

Global Assets - Companies like IND Money (2018) and Vested (2015) started with enabling investments into US stock. This opened up the retail investor to diversify their exposure to global stocks.

Alternative assets - Companies like Grip Invest, Wint Wealth, Jiraaf and Strata allowed retail investor to participate in fractional investment in different assets (Corporate bonds, EV’s, Real estate etc.) by enabling access through low ticket sizes.

REITs - The first REITs were launched in India in March 2019 and in December 2024, the first SM-REIT (Small and medium REIT) was launched by Property Share.

Gold - Digital gold is something that was popularised by startups like Jar in 2021 and now have become main-stream with even companies like Tanishq partnering up with Safegold to provide digital gold to their customers. Apart from digital gold, you can also buy ETF’s on the exchange and Sovereign gold bonds in secondary transactions in the market.

Fixed Deposits - In 2022, Stable Money launched fixed deposits that helped in easy enablement of fixed deposits allowing retail investors to choose from

Increasing Complexity for the Indian Mass affluent consumerThus, given these increased complexity with limited time for the mass affluent investor, the existing solutions are simply not up-to the mark.

The rise in the search term ‘investment advisor’ post-covid also points to the same.

Trust in Digital Finance: Thanks to 10 years of digital finance growth, these customers are comfortable doing high-value transactions online. Five years ago, convincing someone to transfer ₹5 lakh to an app would be tough; today, many did just that for Zerodha or crypto platforms. The COVID era especially boosted trust in managing money online.

Data Availability: With Account Aggregators and CKYC, a wealth app can quickly get a 360° view of a client’s financial situation (with consent) and customise advice. Also, digital footprints (credit history, investment behaviour) allow more personalised and faster advice than a human alone could. For example, Fold Money recently launched a networth calculator and tracker over time based on AA data powered by Finayu. The rise of new apps like Fold Money that are simplifying personal finance management for the consumers validates the need to solve for complexity.

Regulatory support: SEBI’s Investment Adviser regulations allow fintech firms to register as RIAs and charge fees for advice.

What are the opportunities in the space ?

There are multiple people that I have met in the past 12 months who are trying to build a mass affluent solution and also apps that I frequently use to manage my personal finance but there are different approaches that can be clubbed in 4 main categories

Personal Finance Management as a wedge - Companies like Fold Money (Founded are focusing on trying to build a CFO for personal finance, that helps you track your networth, bills, credit cards etc. These are the new features fold is planning to launch this year. While, they do not offer any advisory now, it’s highly likely that they will offer either AI insights based on this data or a human wealth advisory on top of it.

Family as a wedge - Companies like Novelty wealth and FOLO are building an app that would allow you track all your families assets and liabilities in one place.

FIRE Planning for an individual - For people who want to grow their wealth to retire. This is a similar approach to goal-based apps of the past. Companies like Truwealth and Finny are trying to do.

Tech Enablement of SEBI RIAs (Similar to PoSP moment for agents) -Providing a SaaS platform to SEBI registered Registered investment advisors to allow them to sell better by suggesting the best possible product based on algorithms and managing through web allowing them to increase the number of clients per investment advisor served.

All these companies are trying to follow the following play-books

Use a hook that would get the customer interest in the product - All the apps are trying to get a hook that would help to get the customer to install the app and engage it with frequently

Build Trust in the platform- After the initial hook, the next step is to build the user’s trust on the platform. This would be providing any unique insights regarding their financial health and help them improve financially from the status quo to show material financial impact through the app.

Human Layer - I believe human-touch would still be needed as while the transactions would be small initially, eventually the investments would add up to become a significant portion of the net-worth of the individual. The initial relationship will have to be build by the advisors using AI to reduce the time spent per client and increasing the number of clients served per investment advisor. There would be power users, who will then gradually shift towards no human advisory element.

It is hard to predict which one of the models is succeed as of now, there might be multiple winners in the space with each attracting the customer with different hooks. With account aggregator technology getting democratised, it would be founders who can built user journeys that are differentiated that would have a right to win.

The second important factor is building trust because people tend to stick with wealth managers for decades rather than years.

Can wealth management advisory services alone be a sizeable business ?

Given the average fees currently charged by an investment advisor who is SEBI registered is around Rs. 10,000.

In a base case, a startup that can invest 1 mn users to sign-up for their wealth management advisory can make upto Rs.1000 crs on subscriptions alone. This does not include the extra income that the company can generate from selling non-SEBI registered products (Credit Cards, Loans and Insurance) those are big market in their own rights. This seems to be achievable given that the Indian households with mass affluent system is going to expand to 21 mn households by 2027. Even if only 1 person from each household signs up for the service, representing 21 mn users, 1 mn users would tap into ~5% of the market. This seems achievable.

Groww currently has 13.16 mn MAU as of Dec 2024 and raised it’s first VC funding round in Jan 2018. Thus, within 7 years, it has been able to build a strong base of users post-investment.

Valuation

Valuation wise, public wealth managers like Nuvama trade at a median multiple of around 10x , thus, 1000 crores in potential revenue would lead to a creation of 10000 crs company.

What’s the risk here ?

Incumbents entering the space - Incumbents like INDMoney and Groww can acquire SEBI registered investment advisor licenses. If there were to succeed then it might be a risk as these companies already have a large number of customer base to which they can cross-sell their services.

A parallel to this would be offering loans against mutual funds to all their clients, that all platforms including Groww have started doing, thus reducing any competitive edge. A similar one-click AI assisted wealth manager can also be enabled by the companies as a features for an additional fee to access wealth management solutions.

To conclude, it is a good time to start now -

Building a wealth management service serving the Indian mass affluent segment helps a fintech founder to target a very large TAM (14 mn households growing to 21 mn households). The main problem currently is to figure out how to make a scalable offering that would allow either an AI-based or AI assisted human advisory to scale it to 1 mn users or more.

Startups which are able to acquire users through innovate costs and make them stay longer by building trust, would be the ones that would be able to build a venture-scale outcomes in this space.

Mutual Fund distributors main bread and butter is mass affluent and professionals. The trouble is knowledgeable customers in this segment don't want to pay regular MF fees but they want the same kind of support. Any startup trying to operate in this space (with a "digital-first/tech-enabled approach") will inadvertently attract knowledgeable customers, and hence won't survive. Also why do knowledgeable customers (mass-affluent and professional) require this when the answer always has been to make more money, spend less, keep 1 yr emergency stash and invest in low-cost index funds. Investing only gets complicated when you have a lot of money.

The best (and mutually beneficial) business model for serving this segment is actually mutual fund distributors. MF distributors get far more hate than they deserve on online platforms.

One of my friends tried operating in this segment and had a new-found respect for MF distributors.